Many industries are somewhere in the process of adapting to digital transformation. Those that make the transition and keep up with customer expectations and maximize their resources will be in the best position for current and future success. The financial services/banking industry is no different, although you may hear it often referred to as “branch transformation.” This process involves implementing and integrating advanced technology, such as Interactive Teller Machines (ITM) or Interactive Bankers (IB).

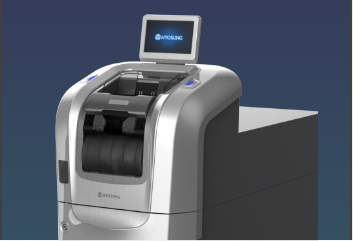

The primary benefit of an ITM is that it blends the ease and convenience of a traditional ATM with the personal touch and professionalism of a live teller. ITMs can be placed in a drive-thru lane and/or inside the branch lobby. Customers can quickly perform basic banking tasks, such as withdrawing or depositing cash, transferring funds, making a loan payment, or checking balances. And, should the customer need to chat with a teller, help is only a click away. Providing this option for customers who prefer this route allows your staff to focus on more complex matters and deliver exceptional service to more traditional customers. ITMs also enable you to serve customers beyond regular bank hours for added convenience.

Now more than ever, it’s about building loyalty through better customer experiences. CBSI understands that and has the expertise and resources needed to help your financial institution make the “bank transformation” with excitement and ease.